Your Change Team just completed a highly successful SAP implementation. Measureable benefits st arted early on and continue to flow in. You were given special recognition at the annual shareholder meeting. Today, you see in the Wall Street Journal that your company, second in its segment, is acquiring the third place firm. You stand by for a call to action by the CEO, but the phone never rings. You know that failure rates in these projects are between 50 and 85 percent. One KPMG study found that 83 percent of these deals hadn't boosted shareholder returns, while a separate study by A.T. Kearney concluded that total returns on M&A were negative.2 Sounds like a high risk proposition. What might you and your team’s role be in a merger-acquisition project? How might you get engaged?

arted early on and continue to flow in. You were given special recognition at the annual shareholder meeting. Today, you see in the Wall Street Journal that your company, second in its segment, is acquiring the third place firm. You stand by for a call to action by the CEO, but the phone never rings. You know that failure rates in these projects are between 50 and 85 percent. One KPMG study found that 83 percent of these deals hadn't boosted shareholder returns, while a separate study by A.T. Kearney concluded that total returns on M&A were negative.2 Sounds like a high risk proposition. What might you and your team’s role be in a merger-acquisition project? How might you get engaged?

Is this a Change Project?

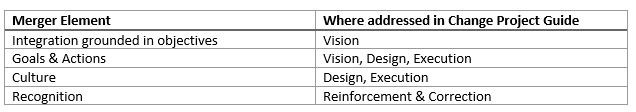

First, let’s look at the principles that are applied to a successful merger and the equivalent process used in a change project

McKinsey & Company advocates the following principles as essential to a successful merger3

- Integration steps should be grounded in the objectives of the deal

- Quantifiable goals should be established, with implementing actions selected and prioritized based on contribution to the goals and ultimately to deal objectives

- Address culture early and often

- Recognize, reward, and promote the most effective team members

TBO’s Change Project Guide has the following components:

- Vision – Clarify the strategy and describe the future state, prepare a case for change including expected benefits and impact on stakeholders, establish a scorecard that defines how the change will be assessed, and engage stakeholders

- Design – Define process, personnel, performance management system, plant, equipment, and tools impact and required changes

- Execution – Apply systematic project and change management practices

- Reinforcement & Correction – Monitor scorecard, recognize and reward performance aligned with the change, take corrective actions, encourage innovation. This step includes continuously monitoring alignment of actions and expectations of the key change project stakeholders.

The following table shows how all the elements addressed by McKinsey are covered by the change elements.

Clearly, all of the key principles required by a merger can be met through the processes of an effective change project.

Let’s take a deeper look at culture?

Simply stated "Culture is the result of what's rewarded and punished in the organization." What gets praised gets done more, and what is not in line with the culture gets punished and is done less.

Simply stated "Culture is the result of what's rewarded and punished in the organization." What gets praised gets done more, and what is not in line with the culture gets punished and is done less.

The elements of culture we need to get in alignment when two or more organizations come together:

- A widely-shared, real understanding of what the firm stands for -- often embodied in slogans

- A concern for individuals over rules, policies, procedures, and adherence to job duties

- A recognition of heroes whose actions illustrate the company’s shared philosophy and concerns

- A belief in ritual and ceremony as important to members and to building a common identity

- A well-understood sense of the informal rules and expectations so that employees and managers understand what is expected of them

- A belief that what employees and managers do is important and that it is important to share information and ideas4

Our contention is just like process or technology systems: the organization needs to look at the elements of culture and determine which ones, if changed after the merger, will make the greatest contribution or eliminate barriers to achieving the business objectives of the deal. Identify the required end state and apply systematic project and change management practices to achieve the desired outcome. This needs to be done in conjunction with changes to process, personnel, performance management systems, plant, equipment, and tools.

What level of commitment is required?

The levels and descriptors below represent increasing levels of commitment with increasing levels of benefit….

Holding On. We merged to acquire a product or capability. Change activities are limited to the very basics required to meet legal and reporting requirements. Strategic vision/deal objectives are not well defined or understood.

Marginal Gain. We merged to achieve a benefit beyond current capability. Change activities focus on back office integration. Objectives tend to focus on operating efficiencies.

Payoff. We merged for long term benefit including the possibility of creating new products and markets. Change activities are part of an extensive program prioritized based on annual goals and targets annual goals and targets. Objectives cover the full spectrum of organization activities and culture.

Conclusion - Should the Change Team expect a call?

The answer is an absolute yes, particularly if you want to get real payoff from the merger investment. Mergers are true change projects that require the same discipline and process that delivered value in your last technology, organization move, or reorganization. Typically, mergers are an infrequent corporate event so senior executives may not be familiar with the application of change management tools and techniques and how they significantly increase the odds for success. Start getting engaged by ensuring that a copy of this article (and footnoted references) finds their way into C-suite inboxes and on the agenda of the next merger planning and integration meeting.

If you would like to get a copy of the TBO Change Project Guide, discuss how to get value out of your next merger or acquisition, or if you completed a merger that’s not delivering on expectations, please connect with me on LinkedIn or e-mail directly at tholtz@tbointl.com. There is no stage in the merger integration process that’s too late for change management to make a tangible contribution.

____________________________________________________________________________________________________

1Mergers as used here refers to mergers and acquisitions

2Margaret Heffernan; Why Mergers Fail; CBS Money Watch; April 24, 2012, http://www.cbsnews.com/news/why-mergers-fail/

3 Rebecca Doherty, Oliver Engert, and Andy West; How the best acquirers excel at integration; January, 2016; http://www.mckinsey.com/insights/corporate_finance/how_the_best_acquirers_excel_at_integration?cid=other-eml-alt-mip-mck-oth-1601

4 Schermerhorn, J.R., Hunt, J.G., & Osborn, R.N. (2005). Organizational Behavior (9th ed.). New York: John Wiley & Sons, Inc.